All Categories

Featured

Table of Contents

- – How flexible is Self-banking System compared t...

- – What are the most successful uses of Policy Lo...

- – What makes Wealth Management With Infinite Ba...

- – What are the common mistakes people make with...

- – Is Privatized Banking System a better option...

- – Can I use Infinite Banking for my business f...

The principle of Infinite Financial works only if you treat your individual financial institution the very same method you would certainly a routine financial institution. As a company owner, you pay a whole lot of money in taxes, whether quarterly or annually.

That way, you have the cash to pay taxes the following year or the following quarter. If you wish to discover more, look into our previous articles, where we cover what the tax obligation benefits of an entire life insurance policy policy are. Infinite wealth strategy and just how you can pay tax obligations via your system

You can quickly provide money to your organization for expenditures. You can offer cash to your organization for payroll. There are several sorts of lendings that you can make to your company. Afterwards, you can pay that money back to yourself with individual passion. There is no factor not to do that since it's stuff that you would certainly be doing month-to-month anyhow.

How flexible is Self-banking System compared to traditional banking?

And we did that exactly. We used our dividend-paying life insurance policy policy to purchase a home in the Dominican Republic. That was our want as long, and it finally occurred when we did thisa mindset change. It's inadequate to only find out regarding money; we require to comprehend the psychology of money.

Well, we utilized our entire life the exact same method we would if we were to fund it from a bank. We had a mid- to low-level credit rating at the time, and the rate of interest price on that car would certainly be around 8%.

What are the most successful uses of Policy Loan Strategy?

Infinite Financial is copying the conventional banking procedure, but you're catching passion and expanding cash instead of the financial institutions. The amount of people are burdened with medical expenses that we in some cases can not pay? We wind up charging them on a charge card and making regular monthly settlements back to that card with principal and passion.

One of the best means to utilize Infinite Financial is to pay down your financial obligation. Infinite Financial gives you manage over your banking functions, and then you really begin to look at the cash in different ways.

Are you curious about doing the very same? Keep reviewing this article and we will certainly show you how. The amount of individuals are strained with student finances? You can pay off your trainee financial obligation and guarantee your children' university tuition thanks to your entire life policy's money value. Everything we recommend below is due to the fact that we know individuals are currently doing it themselves.

What makes Wealth Management With Infinite Banking different from other wealth strategies?

Again, the terrific thing regarding Infinite Banking is that the insurer doesn't ask you, "What is this cash for?" That enables you to use it for whatever you desire. You can use your financings for a range of different things, but in order for Infinite Banking to function, you require to be sure that you follow the 3 regulations: Pay on your own first; Pay on your own interest; Recapture all the cash so it returns to you.

That's due to the fact that this point can expand and take full advantage of however you spend cash. Besides, everybody's way of life is completely various from the following individual's, so what may be practical for us may not be hassle-free for you. Most importantly, you can make use of Infinite Banking to finance your own lifestyle. You can be your very own lender with a way of living banking approach.

What are the common mistakes people make with Infinite Wealth Strategy?

With an entire life insurance policy policy, we have no risk, and anytime we understand what is taking place with our cash due to the fact that only we have control over it. Where life insurance policy company should I get my whole life policy? It will depend upon where you live. However the only point you must remember is to obtain your entire life insurance policy policy from among the common insurance firms.

When you place your money into banks, for you, that cash is just resting there. It implies the sum you put in grows at a particular passion rate, yet just if you don't utilize it. If you require your cash for something, you can access it (under some problems), yet you will certainly disrupt its development.

Is Privatized Banking System a better option than saving accounts?

To put it simply, your money is aiding financial institutions make even more money. So, you can not develop riches with normal financial institutions since they are doing it as opposed to you. .

This enables you to become your very own lender and have more control over your cash. You can find out the limitless financial pros and disadvantages to see if this approach is a great fit for you and your organization. Among the advantages is that you can earn compound rate of interest on the funds in your plan, which can possibly grow at a greater price than typical financial savings accounts.

This is specifically advantageous for business owners that intend to pass down their service or leave a substantial quantity of wide range for future generations. Flexibility and control: As the policy owner, you have full control over exactly how you utilize the money value in your entire life insurance policy policy. You can select when to access the funds, just how much to obtain, and how to utilize them.

We will dig into exactly how unlimited banking jobs, its advantages, the process of setting up a policy, the threats and limitations, and choices available. The Infinite Banking Idea is a financial technique that has actually gotten popularity in recent times, specifically in Canada.

Can I use Infinite Banking for my business finances?

The benefit of this technique is that the rate of interest paid is usually comparable to what a financial institution would bill on a similar funding, is commonly tax insurance deductible (when utilized for financial investment purposes for instance) and the funding can be paid back at any type of time with no penalty. Additionally, by obtaining from the plan's cash money value an individual can build a self-funded resource of resources to cover future expenditures (ie turning into one's own lender).

It is vital to understand that boundless banking is not a one-size-fits-all approach. The efficiency of boundless banking as a savings plan depends on different variables such as a person's financial standing and even more. Boundless banking is an economic principle that entails utilizing an entire life insurance policy plan as a savings and investment vehicle.

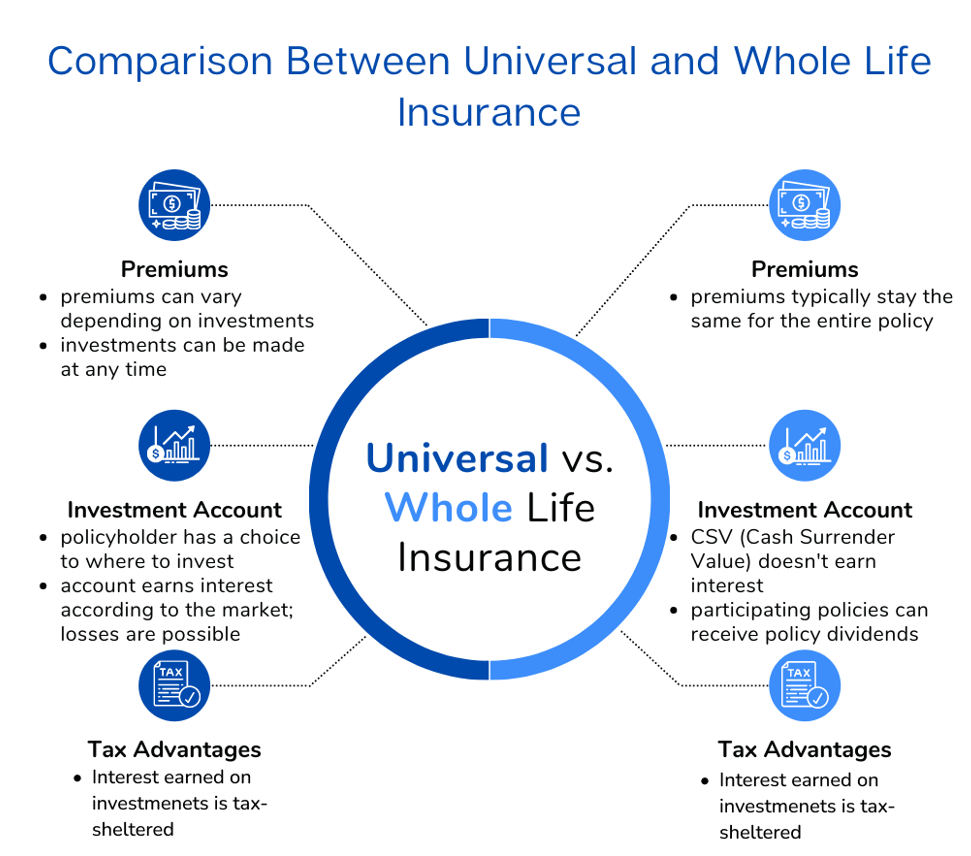

It is necessary to recognize the structure and type of Whole Life plan created to optimize this method. Not all Whole Life plans, even from the same life insurance coverage firm are designed the very same. Whole life insurance policy is a type of irreversible life insurance policy that provides protection for the entire lifetime of the insured person.

This supplies the policy proprietor reward choices. Dividend choices in the context of life insurance describe exactly how insurance policy holders can choose to make use of the rewards generated by their entire life insurance policies. Returns are not guaranteed, however, Canada Life Which is the earliest life insurance policy company in Canada, has not missed out on a dividend repayment because they first established an entire life policy in the 1830's before Canada was even a nation! Here are the common reward choices readily available:: With this choice, the insurance holder utilizes the dividends to acquire extra paid-up life insurance policy coverage.

Table of Contents

- – How flexible is Self-banking System compared t...

- – What are the most successful uses of Policy Lo...

- – What makes Wealth Management With Infinite Ba...

- – What are the common mistakes people make with...

- – Is Privatized Banking System a better option...

- – Can I use Infinite Banking for my business f...

Latest Posts

Infinite Banking Calculator

Banking Concepts

Infinite Banking Illustration

More

Latest Posts

Infinite Banking Calculator

Banking Concepts

Infinite Banking Illustration